Advances in technology and cloud computing have made working from anywhere possible. Recent tax amendments in the latest federal budget have also incentivised this, allowing businesses to give their staff all the equipment they need to be truly mobile.

Up until now the government would only let businesses claim a fringe benefits tax exemption for either a laptop or a tablet, but not both. When smartphones, tablets and laptops are used in very different ways, and for different tasks, this rule was a strange anomaly.

However, with a change introduced in May’s Federal Budget, from April 1 next year businesses will now be able to give their workers both a laptop and a tablet without being hit by FBT.

For some workers, there are good reasons for having mul devices. Laptops are great for more intense working; essentially anything that needs a lot of typing and document handling.

Tablets, on the other hand, are for quicker tasks like checking emails and browsing the internet. Their size means they really can be used anywhere, so allow for more people to work from the park, or a cafe, without needing to lug a heavier laptop around. That said, increasing capabilities and an ever–increasing range of apps are making tablets more and more useful. And hybrid computers, which are half-laptop and half-tablet, are improving every day.

Smartphones are now also a common tool for most workers, enabling them to perform a whole range of tasks on the road, and allowing employees and business owners to be more productive, particularly outside of typical business hours.

Equipping your staff with the equipment they need to be truly mobile will make your business more efficient and productive. Workers won’t need to return to the office to do paperwork; they can make better use of their time on the road. And if used judiciously, these devices can help staff achieve a better work-life balance.

ANYWHERE, ANYTIME

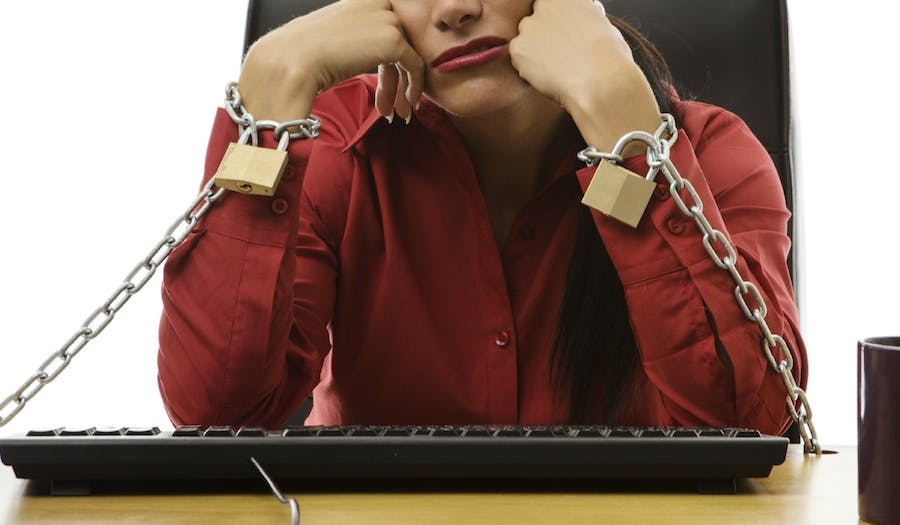

So many of the jobs that used to be tied to the desktop computer can now be performed on a tablet or laptop.

For instance, tradesmen on the road used to have to wait until the end of the day to catch up on their accounts and send out invoices. Now, using an accounting application like Xero, they can send an invoice from the truck as soon as they’ve finished the job, freeing the up to spend more time earning income for the business.

A host of apps can manage things like diaries, job sheets, timesheets and scheduling with no need for the worker to come into the office to pick up the paperwork.

Or the accounts person (and if you own a small business that’s probably you) can use a few minutes between appointments to log into Xero and check who has paid their invoice and who hasn’t. This is information which updated automatically updated using information from the business’ bank account.

BRING IN THE CLOUD

Cloud computing means that files and data aren’t tied to a single computer or an office-based server. Instead, they can be accessed anywhere from any device.

A worker on the road can essentially have the entire office on their laptop or tablet.

For instance, someone who’s at the airport waiting for a flight could review a presentation that a colleague has been working on and make comments for them to act on.

WORKING FROM HOME

Once you’ve freed your workforce for a desk, you can let them work from home. Obviously, you need to assess the individual and their specific role before you make any decision. Cloud-based tools such as sharable documents and spreadsheets allow people in different locations to work on documents at the same time, so even collaborative roles need not be confined to the office.

Offering staff the opportunity to work from home for even part of the week is a great employee benefit, especially for those with a long commute, and should help you retain valued staff.

BE READY

Along with the tax changes to smartphones, tablets and laptops, the Government will spend $255 million over the next four years updating its systems and the way it interacts with businesses and individuals. This should save time for small businesses, many of whom deal with the government online to do things like applying for an Australian Business Number, registering a business name or paying their taxes.

It’s all the more reason to have your own systems up to date, so you can easily interact with the government online, instead of via paper form.

Now you can set your staff free from their desks – and reap the benefits.

The information contained in this article is general in nature and does not take into account your personal situation or your business circumstances. You should consider whether the information is suitable to your needs, and where appropriate, seek professional advice from an accountant or other qualified professional.

About the Author:

Written by Chris Ridd, Managing Director of Xero Australia.